Tax Code Has Gotten Much More Regressive Since 2018; Eliminating the Income Tax Would Widen Disparities Astronomically

Arkansas’s tax system is upside-down (sometimes referred to as “regressive”), with the wealthy paying a far lesser share of their income to tax than low- and middle-income families. Policy changes made since 2018 have widened this disparity, and eliminating the personal income tax would widen it even further. That’s according to the latest edition of the Institute on Taxation and Economic Policy’s Who Pays?, the only distributional analysis of tax systems in all 50 states and the District of Columbia.

The regressivity in Arkansas’s tax code is largely driven by our over reliance on sales taxes, which fall more heavily on lower- and middle-income Arkansans. And for years we’ve been cutting income taxes in a way that primarily benefits rich corporations and the wealthiest individuals. We also allow corporations to game our tax system, and we tax capital gains income at a lower rate than earned income, benefiting almost exclusively the wealthiest and even out-of-state shareholders. Lawmakers could help fix this imbalance by halting further income tax cuts, implementing combined reporting requirements on corporations, and investing our public dollars in programs that ensure every Arkansan can participate in a thriving state economy.

“Arkansas’s tax system is set up in a way that makes things easier for some people and harder for others,” said Keesa Smith, executive director at Arkansas Advocates for Children and Families. “But it’s everyday Arkansans who drive our economy, and their prosperity and well-being should be the central focus of our tax system. We hope this data helps Arkansas’s lawmakers reconsider their tax policy priorities and start making investments in our communities so every kid in Arkansas has a chance to thrive.”

The report’s key findings for Arkansas:

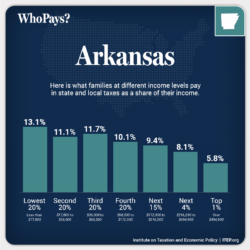

- The lowest-earning 20% of taxpayers have a state and local tax rate that is 126% higher than the top 1% of households. The average effective state and local tax rate is 13.1% for the lowest-income 20% of individuals and families, 11.7% for the middle 20%, and 5.8% for the top 1%.

- Arkansas has the 9th most regressive tax system in the nation.

- Without the tax cuts and other tax changes that have occurred since 2018, however, Arkansas would have the 15th most regressive tax system in the nation. In other words, policymakers’ actions since 2018 have caused Arkansas to fall 6 spots on the ITEP Inequality Index.

- Eliminating the personal income tax would cause Arkansas to fall another 7 spots on the Index, giving it the 2nd most regressive tax code in the nation. Under that scenario, the lowest-income 20% of taxpayers would pay a state and local tax rate that is 348% higher than the top 1% of households.

- Arkansas is one of 41 states that tax the top 1% less than every other income group, and one of 34 states that tax their poorest residents at a higher rate than any other group.

Nationally, tax systems in 44 states exacerbate inequality by making incomes more unequal after collecting state and local taxes, while systems in six states plus D.C. reduce inequality, the report finds. On average across the country, the lowest-income 20% of taxpayers face a state and local tax rate nearly 60% higher than the top 1% of households. The nationwide average effective state and local tax rate is 11.3% for the lowest-income 20% of individuals and families, 10.5% for the middle 20%, and 7.2% for the top 1%.

“When you ask people what they think a fair tax code looks like, almost nobody says we should have the richest pay the least. And yet when we look around the country, the vast majority of states have tax systems that do just that,” says Carl Davis, ITEP’s Research Director. “There’s an alarming gap here between what the public wants and what state lawmakers have delivered.”

Get the report here, and for AACF commentary and context on the data, read our blog post.