Download this handout: Tax and Budget

Investing in Families

Every issue in this guide connects to taxes. We need tax revenue to make the public investments necessary to support children reaching their full potential. A good tax plan is balanced and doesn’t rely too much on any one type of tax. A good tax system is also transparent. It should also be adequate, meaning that we have enough to fund the public investments that we all care about. And finally, it should be based on a family’s ability to pay. The state budget is a moral document. If we truly care about the needs of our children and families, we need a budget that funds the programs they depend on.

A Tax System That Works for All

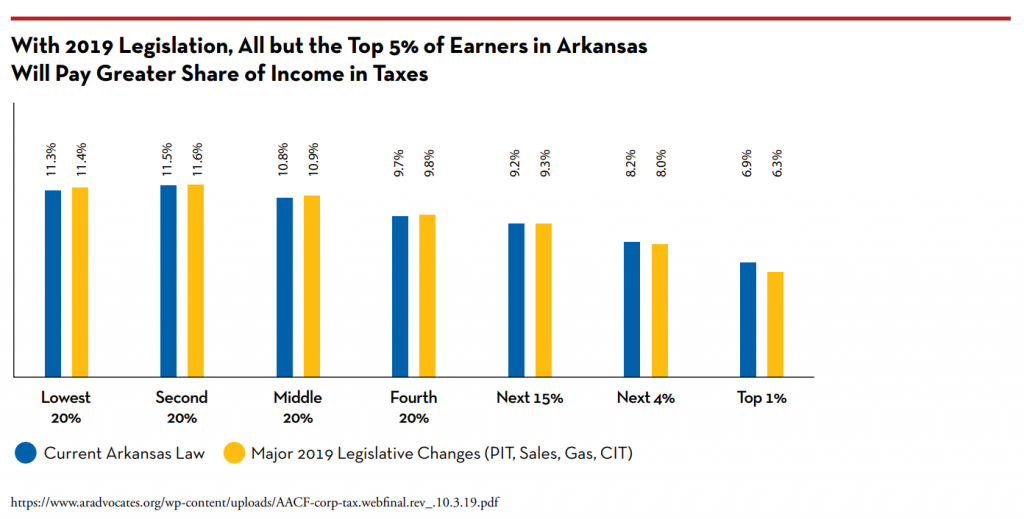

Arkansas has a regressive tax system, which means low-income people are paying a higher percentage of their income in taxes, when all taxes (including income, property and sales) are considered. Low-income Arkansans have long paid more as a share of their income in state and local taxes compared to the wealthy. Tax cuts to corporations and top earners have made this worse in recent years. A weak state budget threatens the well-being of kids who depend on things like an adequately funded state foster care system, summer reading programs, pre-K, and a strong public education system.

What to Ask Candidates

- How much will this tax change cost (or save) a middle-income family? (What about low-income and upper-income earners?)

- If there is a tax cut, how will we make up for lost revenue? Will taxes be raised in other areas, or will there be budget cuts?

- Which programs will be reduced or lost because of this tax cut?

- How will you make sure that tax changes benefit regular Arkansans and not just wealthy taxpayers?

- Instead of cutting taxes to benefit a few, how could we use this money to pay for new programs that benefit many?

Download this handout: Tax and Budget

You must be logged in to post a comment.