Download this handout: Family Economic Well-Being

Helping Working Families

We can do more than just protect programs that help our kids succeed. We can demand more on their behalf. A state Earned Income Tax Credit (EITC) would allow low-income working families to keep more of what they earn and move up the income ladder. An EITC is proven to have long-term benefits for children’s health, educational outcomes, and even future career options and job security. The EITC is a straightforward way to help low-income families that also helps address the regressive nature of our state tax system. When all taxes are considered, including income, property

and sales taxes, the top 1% pay less as a share of their income than those with lower incomes.

Protecting Programs Kids Need

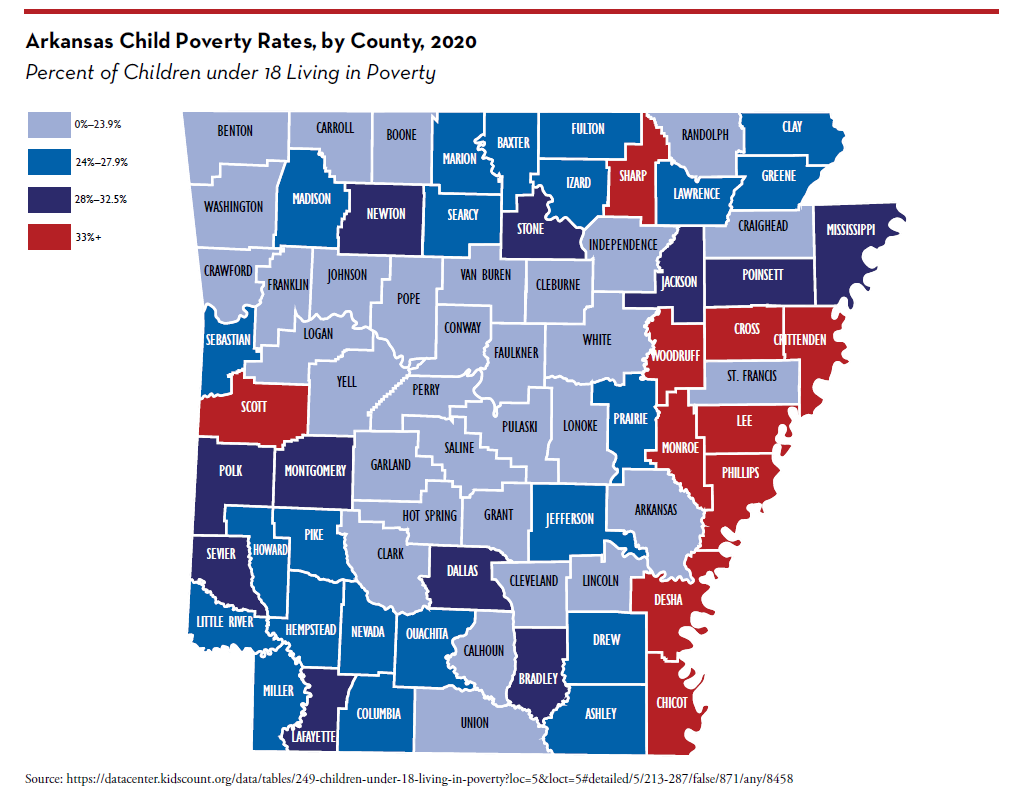

Because many Arkansas jobs pay wages that are too low to meet the needs of families, many full-time working families in the state live in poverty. About a quarter of the kids in Arkansas grow up in poverty and rely on social safety net programs, such as Medicaid or the Supplemental Nutrition Assistance Program (formerly “Food Stamps”) to meet basic needs. Protecting these types of programs means protecting the futures and aspirations of all kids in Arkansas.

What to Ask Candidates

- What do you see as the biggest financial barriers preventing low-wage workers in Arkansas from getting ahead?

- What kinds of policies would you like to see help families who work full time but still can’t make ends meet?

- How will you protect social safety net programs that help low-income families in Arkansas meet their kids’ basic needs?

Download this handout: Family Economic Well-Being

You must be logged in to post a comment.