Arkansas’s 93rd General Assembly has the chance to provide $50 million in tax cuts for the lowest-wage Arkansans who need it most, and the smartest way to target that tax relief is through a state Earned Income Tax Credit (EITC). The Governor’s proposed budget for the upcoming biennium includes unspecified income tax cuts for “low-income” Arkansans, amounting to $25 million in 2022 and $50 million in 2023, and it will be up to legislators as to how to allocate the cuts.

We are encouraged that Gov. Hutchinson recognizes the need to help struggling Arkansas families, and we urge state lawmakers to ensure this opportunity will be good for local economies and lead to healthier and more successful children in our state. Research shows the EITC encourages work and improves children’s health, education, and later life work outcomes.

One reason a state EITC is the best way to cut taxes for low- and middle-income Arkansans is because it is the most targeted way to put money back in their pockets. It builds on the federal EITC, which is so successful at investing in working families, 29 states plus the District of Columbia have adopted their own state-level versions. Around 300,000 Arkansans who work for a living, yet still struggle to make ends meet, could claim a state EITC. Many of these Arkansans are parents with children at home.

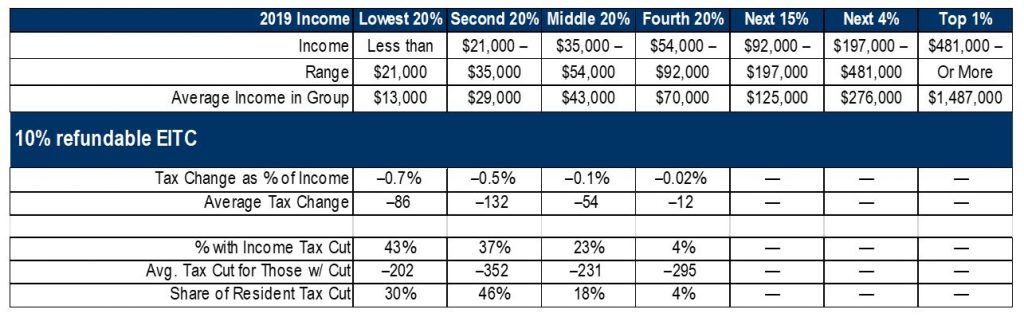

With a state EITC, nearly all the benefits would go to working Arkansans with $54,000 or less in annual income, with the vast majority going to those earning $35,000 or less. An analysis by the Institute on Taxation and Economic Policy shows what this means:

The extra income an Arkansas EITC would provide could help families pay for things some of us take for granted, like regular checkups at the doctor or being able to pay rent on time. That’s why increases to the EITC in other states have been linked to improved infant and maternal health, better test scores, a better chance at attending college, and even higher salaries later in life. Arkansas needs its people to thrive, not to scrape by.

Arkansas’s counties with higher poverty rates could also see a boost from an Arkansas EITC. Tax credit refunds are usually spent close to home. Economists estimate that for every $1.00 spent on the EITC, there is a $1.50 to $2.00 impact on the local economy. That means more earnings for local businesses, more local job opportunities, and more tax revenue for cities and counties.

An Arkansas EITC is the most effective way to use the Governor’s proposed tax cuts for low-income Arkansans. From helping reduce poverty and improving health outcomes to boosting local economies, the EITC brings widespread benefits in those states that have enacted it. It is time for Arkansas to provide this targeted tax relief to working, low-wage Arkansans.