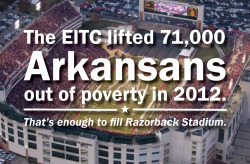

A state-level refundable Earned Income Tax Credit (EITC) is one of the most widely accepted and successful methods of fighting poverty and encouraging workforce participation. A state-level EITC in Arkansas would promote economic opportunity and ensure that all Arkansans families have the ability to be a productive part of the Arkansas workforce. It would also mean a more fair tax system for low-income Arkansans, fewer families living in poverty, and a boost to our local economy. State-level EITCs are also simple to implement because they are based on the federal version, which is already in use.

Find out more in our new issue brief, “A Boost For Working Families.” In it, we make the case for a state-level EITC.

What is an EITC? EITCs are credits that reduce the amount of taxes that low-income families owe. For low-income workers, the more you earn, the more you get back in credits. The idea is to encourage work until, eventually, you earn enough that you don’t qualify for the credits. A state EITC in Arkansas would piggyback on the federal version, which is proven to encourage considerable numbers of single parents to leave welfare and enter the workforce. EITCs did more to increase employment among single mothers than either welfare reform or economic recovery during the 1990s. Local economies benefit from EITC programs, too. One study found that every dollar of EITC refunds resulted in $1.58 in total economic activity, and every $37,000 supported a permanent job in the community.

Both sides of the aisle sing the praises of EITC programs. Since its inception, the EITC has received broad bipartisan approval because it supports working Americans and has been the most effective measure ever enacted to help families leave poverty behind. Without a state level EITC, Arkansas is missing out on its full share of one of the most successful antipoverty measures ever introduced. Unlike about half of the states in the US, there is no state-level EITC in Arkansas.