The GOP tax bills in both the House and Senate propose to increase the maximum Child Tax Credit from $1,000 to around $1,600 per child. While GOP leaders have hailed these proposals as a major tax cut for working families, the reality is that both would leave out millions of children in low-income working families while making more higher income families eligible for the credit.

This is a huge missed opportunity to help our working families.

First, the House proposal. It would increase the credit from $1,000 to $1,600. According to a new analysis from the Center on Budget and Policy Priorities, it would leave out or give only partial benefits to 46 percent of children in working families. About 20 percent, or 120,000 Arkansas children in working families, would be completely excluded from the change. Another 26 percent, or 153,000 Arkansas children in working families, would receive less than the full value of the $600 increase proposed in the credit under the House bill.

Currently, the Child Tax Credit is only “partially refundable,” which means that families with incomes too low to owe federal income tax only partially benefit from it. The refundable part of the credit is currently limited to 15 percent of a family’s income over $3,000 (no refundability for incomes less than $3,000). Because of the credit’s slow phase-in, families with two children do not receive the full $1,000 credit until their income reaches $16,333. The poorest children in working families qualify for only a small credit, or none at all.

The House proposal to increase the maximum would do nothing to make the credit more available for low-income working families (it still would be limited to 15 percent of earnings over $3,000). In other cases, low income families would receive just a partial bump up in the credit. However, the House proposal would increase the income level at which the credit phases out, thus making more higher income families eligible to take advantage of it. Under current tax law, a married couple with two children and income above $150,000 aren’t eligible for the Child Tax Credit. But in this proposal, couples with two kids who make between $150,000 and $294,000 would be eligible for the credit for the first time.

It’s not a bad idea to make more families eligible for the Child Tax Credit, but it is bad policy to fully extend it to higher-income people without making it available to more lower-income families at the same time.

The House proposal sets up major inequities in who benefits and how much they benefit from the House bill’s proposed change:

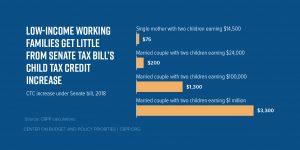

- A single mother with two kids earning just $14,500 would be completely left under the House proposal and receive no increase in her credit.

- A married couple with two kids earning $24,000 would only receive a $100 increase in the credit per child (a total increase of $200).

- A married couple with two kids earning $200,000 would be newly eligible and would now receive a $3,200 credit for the first time.

The new Senate proposal is just as disappointing. The GOP plan proposes a similar increase in the maximum credit per child: from $1,000 to $1,650. But it lowers the income threshold at which the refundable part kicks in from $3,000 to $2,500. According to a new analysis by the Center on Budget and Policy Priorities, one in seven children – 10 million children nationwide – in low-income working families would receive a credit of increase of just $75 (or none at all in some cases). Another 14 million children in low income working families would receive less than the proposed full credit increase of $650 per child. Altogether, one in three children under the Senate proposal would receive either a token or partial increase.

Given the similarity of the House and Senate proposals, it’s likely the Senate proposal would have roughly the same impact on Arkansas children in working families – hundreds of thousands of Arkansas children in working families would receive a token increase in the credit, no increase at all, or just a partial increase less than the proposed $650.

Like the House version, the Senate plan would not only severely limit the increase for the children who would benefit the most, but it would expand eligibility for many high-income families who currently earn too much to claim it. But unlike the House, the Senate version would include families with income up to $ 1 million a year. A family of four with an income of $1 million who previously would not have qualified for a child tax credit now could receive of credit of $3,300. This hardly seems like “reform” when a single mother of two making $14,500 would see a paltry $75 increase.

Even with the Senate’s proposed changes in the Child Tax Credit, the overall tax plan would still suffer from the same fatal flaws as the House bill. That is, most of the benefits would go to the wealthy and our most profitable corporations; the small tax cuts that low- and middle-income families would get in the beginning would decline over time; the bill would eventually have to be paid for with budget cuts; and any benefits low- and middle-income families receive would be wiped out over time because they would bear the brunt of budget cuts in health care, education, financial aid for college, nutrition assistance, job training, and key programs.

Helping families that are struggling to make ends meet gives kids a better shot at success. Research suggest boosting parents’ incomes helps children do better in school, and makes them healthier and more likely to go to college. That’s good for Arkansas kids and the Arkansas economy. Leaving kids out makes no sense for the future of our state, especially, since we have a higher child poverty rate than most. If we are truly serious about real tax reform for our working families, we must go back to the drawing board and make major changes to the Child Tax Credit. We need to do it in a way that would really help working families, as well as consider other options like a meaningful expansion of the Earned Income Tax Credit.